Welcome to Thursday team.

It’s a busy one, with Kogan.com raising $100 million in an ASX share placement. More on that here.

1. Here’s looking at you Jeff

Reading the room, and perhaps also pushing for a seat at the table as US legislation is finally drawn up to deal with the use of facial-recognition technology, Amazon announced a year-long moratorium on US police using its algorithm-driven Rekognition technology. The move comes as some law enforcement groups, including the Oregon’s Washington County Sheriff’s Office, announced they were suspending use of the tech, and came 48 hours after IBM announced it was getting out of facial recognition because of racial bias, with CEO Arvind Krishna writing to Congress saying it’s unconscionable because it’s employed “for mass surveillance, racial profiling, violations of basic human rights and freedoms”.

Amazon said it hope the moratorium “might give Congress enough time to implement appropriate rules, and we stand ready to help if requested, arguing it had previously advocated for governments to introduce stronger regulations on the ethical use of facial recognition technology, and now “Congress appears ready to take on this challenge.”

Dr Jathan Sadowski, Research Fellow in the Emerging Technologies Research Lab at Monash University’s Faculty of Information Technology was on the Startup Daily show on Ausbiz today (2-3pm weekdays) and says Amazon will continue to provide facial recognition services, as well as other surveillance infrastructure, to a wide range of non-policing organisations and the move’s is not an altruistic gesture.

“t’s a calculated business decision and should be treated as such. While it’s doing more than the hollow marketing push about Black Lives Matter by every company right now, it is ultimately in the same vein of action,” he said.

“It’s much easier and more ethical to ban facial recognition than it is to try to create ‘best practices’ for ‘ethical us’ of technology as dangerous as facial recognition.”

2. Loan long and Prospa

Fintech business lender Prospa has delivered a solid March quarter with $122.8 million of total loan originations and $37.4 million of revenue, both in line with management’s expectations. Group revenue during the quarter was $37.4 million, up 13% on the prior corresponding period

In an ASX filing this week, the Sydney-based lender said it provided 5,501 customers with relief packages, including short-term payment deferrals and reduced repayments, yet 18.6% of customers on full deferrals had returned to full repayments since May 15.

Operating expenses have been stepped down for Q4FY20 and are expected to be approximately 32% lower than for the prior quarter Q3FY20. Unrestricted cash increased from $43.8 million as at 31 December 2019 to $61.9 million as at 31 May 2020, for an improved liquidity position via reduced spending and reduced originations.

In additional news today, Prospa said the Australian Office of Financial Management had approved a maximum investment of $90 million into a Prospa warehouse trust through the Structured Finance Support Fund.

Prospa CEO Greg Moshal said the move recognised the importance of small businesses for economic recovery.

“This investment through the SFSF of up to $90 million into our lending capacity, coupled with our $223 million allocation through the SME Guarantee Scheme, comes at a critical time,” he said.

“These programs will work together and enable Prospa to quickly deliver funding to small businesses and support Australia’s economic recovery.”

3. Grubhub’s plan B

US food delivery service Grubhub is merging with European rival Just Eat Takeaway.com in a deal that values the company at more than A$10 billion.

The business, which has a less-than-stellar reputation, had been in merger talks with Uber, which walked away amid concerns over the company’s behaviour and likely antitrust (aka competition) investigations by US regulators.

The stock-swap deal sees sees a Grubhub share worth 67% of Just Eat stock at an implied value of US$75.15 – around US$7.3 billion – a Just Eat company statement said.

Just Eat says the merger will make it the world’s largest online food delivery company outside of China.

4. Open banking sandbox ready for play

Ping Identity has released of its Australian Consumer Data Right (CDR) “sandbox” for banks and fintech working on open banking compliance.

For tier one banks and large financial institutions, CDR-compliant data sharing needs to be in place by July 1, with tier two banks and smaller firms granted an extension until July 2021 due to covid-19

Ping Identity APAC CTO Mark Perry said his company’s CDR sandbox offers a pre-built development environment to get started quickly without the cost of custom development.

“It is also a flexible platform for future digital transformation that can be used for other identity security projects across the enterprise,” he said.

You’ll find more on it if you’re interested here.

5. Tesla shares hit $1000

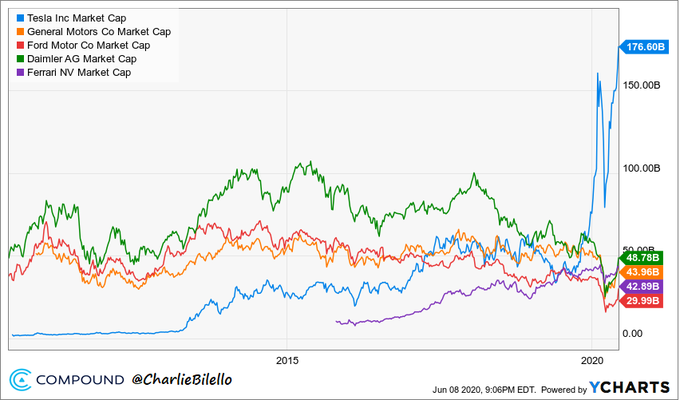

First up, a chart from Charlie Bilello, CEO of Compound Capital Advisors, that shows Tesla’s market cap is worth $10 billion more than GM, Ford, Daimler, and Ferrari combined.

That was yesterday. Today Tesla’s share price topped $1000 (A$1425) after Reuters reported on a leaked email from CEO Elon Musk about plans to finally get cracking on a electric semi-trailer.

The prototype first emerged in 2017 and while there was no details on when it will ramp up, he’d previously flagged volume production by 2021.

“Production of the battery and powertrain will take place at Giga Nevada,” the Musk email said.

Trending

Daily startup news and insights, delivered to your inbox.