Neobanks and fintech lenders such as Xinja, Judo, Get Capital, Society One and Volt Bank dominated Australian startup sector funding in the first quarter of 2020 in a boom-time beginning to the year.

Startup sector analysts Techboard hve been monitoring Australian startup and tech sector growth since 2017 and the March quarter 2020 was the second highest in that time with A$1.75 billion in funding secured. That level is only surpassed by the March quarter last year at $2.739 billion, but that figure included the A$1.6bn PEXA acquisition, so this year has been strong ahead of covid-19’s sting.

Several very large rounds by five neobanks and fintech lenders accounted for 70.4% of the funding raised and the 2020 March quarter set a record for private investment captured by Techboard at $1.2 billion captured. The vast majority of that private investment went to fintech (79%), and in particular, the top 3 private investments for Xinja, Judo Bank and Volt Bank totalled $903 million of the $962 million raised by fintechs.

The loin’s share of funds went to NSW companies at 57.4% (more than $1bn), followed by Victoria at 34.1% ($616m)

The highlights for the quarter include:

- Largest funding event and largest private investment: Xinja, $433m

- Largest IPO: Thedocyard, $26.5m

- Largest placement listed fintech: WISR, $33.5m

- Largest reported debt: fintechs GetCapital and SocietyOne each announcing $100m facilities

- Largest reported value acquisition: Edtech Smart Sparrow by Pearson for $36m.

- Largest equity crowdfunding raise: Seabin with $1.8m raise on Birchal

The Techboard boss believes the trend was looking good before coronavirus hit the economy

“The funding being announced will generally have taken up to six months to secure and stories are circulating of funding falling through/offers of funding being withdrawn,” he said.

“So given the strength of funding in the first four months of 2020, we can deduce that were it not for covid the strong underlying growth we had been seeing would continue.”

Nonetheless, van Bruchem says that when you break down the data, a less rosy picture starts to emerge and that reinforced by talk of many companies planned funding events not going ahead.

“While we can take some positives from the data, it could have been much better news had we not been hit with coronavirus,” he said.

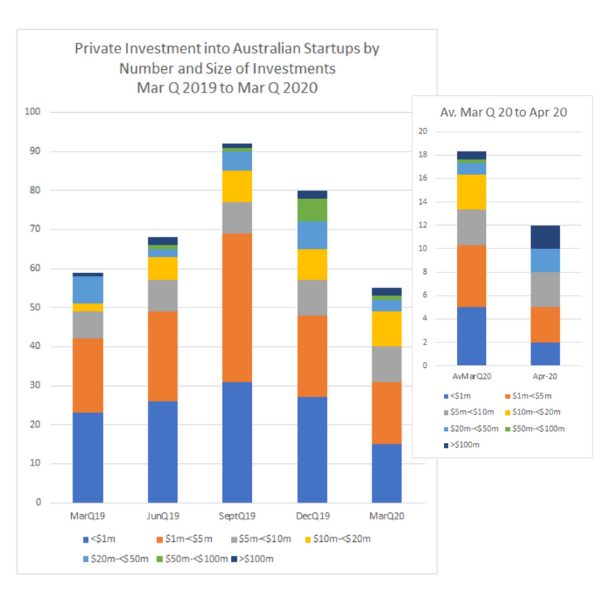

“Over the last year or more we have been observing a number of trends that we have reported on previously the most notable have been the downwards trend in the number of published deals and the general increase in deal size.

“What we are seeing from the March quarter and flowing into April is a reduction in the number of published deals and a reduction in the overall amount of private funding coming from sub-$100 million investments and a reduction in the number of sub-$100m large scale investments.”

van Bruchem said that matches what they are hearing anecdotally.

It seems that in the absence of covid-19, we would have seen a continued growth on what we had seen in previous periods,” he said

He’s now working on the May data to release it as soon as possible, along with the annual funding report for the 2019-20 financial year.

Private investment in the March quarter 2020, by deal size and number. Source: Techboard

Trending

Daily startup news and insights, delivered to your inbox.