Buy-now-pay-later fintech Afterpay has moved to reassure shareholders after the company’s share price went over the cliff amid concerns about its future as coronavirus provokes an economic crisis.

Yesterday the Reserve Bank cut interest rates to the RBA’s stated floor of 0.25%, as well as launching a $90 billion bond-buying program to keep interest rates low and support small business. Treasurer Josh Frydenberg is also tipping $15 billion into wholesale funding markets to support small banks and non-bank lenders to lend to SMEs. A tumbling Australian dollar against the Greenback also makes the ASX-listed fintech less appealing to overseas investors.

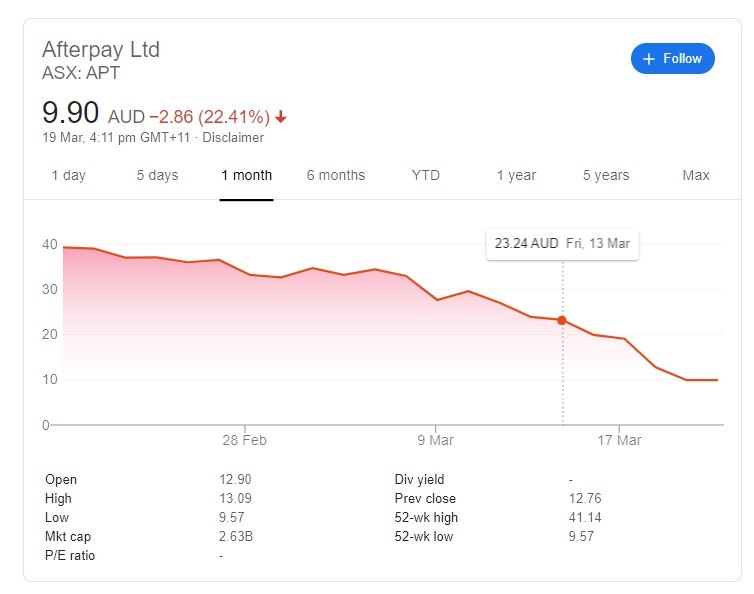

Afterpay’s (ASX:APT) share price fell 33% on Wednesday, and a further 23% on Thursday to sit at $9.90. The company’s value had more than halved in value since last Friday.

Afterpay’s share price since Feb 20. Source: Markets.com.au

But in morning trade on Friday, Afterpay’s share price has come storming back after opening more than 10% up at the start of trade. The price leapt more than 40% to a high of $14 amid continued volatility for its shares.

Afterpay’s share price in early trade on March 20.

There are concerns that the consumer lender is now in a perfect storm of liquidity problems – something the RBA and central banks around the world are seeking to address – a massive contraction in consumer spending that could potential slow future sales, and potential defaults on repayments as people lose their jobs or have their working hours cut back.

In a letter to shareholders on Thursday, Afterpay CEO Anthony Eisen said COVID-19 is creating unprecedented circumstances that are causing significant concerns in financial markets across the world. He tackled the issue of the company’s falling share price – just 29 days ago, before the market rout began, it sat just under $40 – head on, saying the company was “unaware of any information, outside of the current uncertainty in the market generally, that would have precipitated recent share price performance”.

Eisen said Afterpay’s business model, balance sheet and customer base “creates a level of protection in times of economic uncertainty” and they had not see a material impact on business activity and timing of instalment repayments or transaction losses to date.

Average transaction value is A$150, with the average outstanding balance at A$211, with “no material concentration in our portfolio from a merchant or customer perspective”.

“We are able to manage losses in real time by identifying leading indicators early and modifying risk parameters in the system immediately,” he said.

“Our strong balance sheet and liquidity position provides us with the capacity to both continue to fund our operating expenditure and significantly expand our business activities in the medium term.”

The company has more than A$1.09 billion of warehouse facilities, with major financial institutions, liquidity position of over A$672.1m and cash on balance sheet at A$402.5m.

A third of the warehouse facilities are drawn.

Afterpay Day, which began yesterday, and continues through today, went ahead, Eisen said, because ” it is important that we continue to support our merchants who are rapidly looking to increase their online exposure in the current environment”.

The company asked employees to work from home and Eisen said that happened “seamlessly with no disruption to our service”.

Afterpay is one of the top 10 tech companies in the ASX All Technologies Index launched on February 24.

Trending

Daily startup news and insights, delivered to your inbox.