SME lender Prospa’s week from hell for its investors continues after the fintech announced on Monday that it would undershoot its prospectus forecasts for 2019.

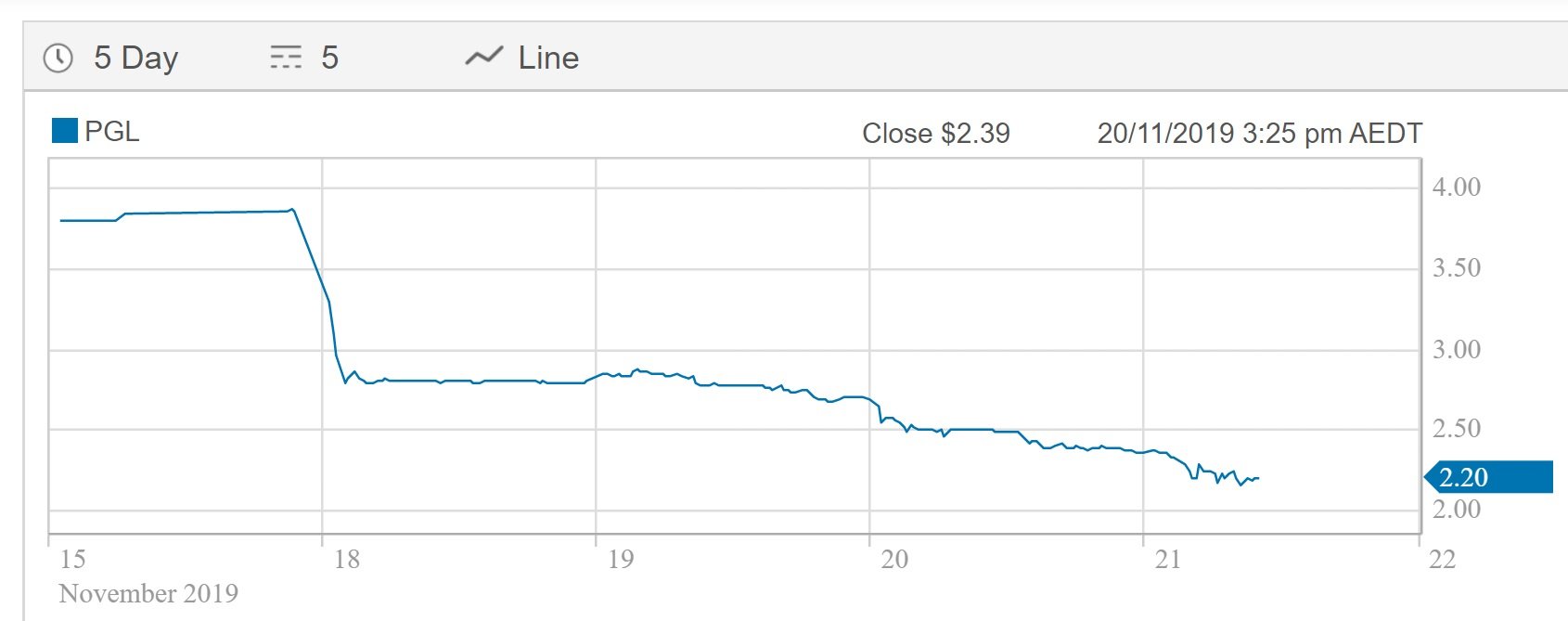

Here’s the chart, courtesy of CommSec, that tells the story.

Chart courtesy of CommSec.

Prospa (ASX: PGL) shares are down another 6.38% in lunchtime trade on Thursday to $2.20.

The SME business lender listed on the ASX on June 11 at $3.78 a share, raising $109.6 million.

On Monday, the company told the market it expects total revenue for CY2019 will be down 8% on the prospectus prediction of AU$143.8 million, attributing the reduction to charging lower rates of interest because it was attracting lower risk, better quality small business borrowers.

The company revised down its prospectus forecast on the annualised simple interest rate paid by customers in CY19 by 0.5% to 19.2%. The changes also saw Prospa’s prospectus EBITDA (earnings before interest, tax, depreciation and amortisation) drop 62% from $10.6 million to $4 million.

The company blamed the change on acceleration of growth investment; a number of one-off expenditures; and “some cost over-run which we currently addressing”.

The business remains positive about its longer term, with joint CEO and co-founder Greg Moshal saying on Monday that while there were “some short-term impacts on our forecasts, the business was largely on track”.

While Prospa shares staged a brief rally on Tuesday morning, they’ve been in steady decline ever since, hitting a new record low on Thursday of $2.16 today.

The one bright spot for the fintech amid so many analysts considering a range of tech stocks over-valued is that Morningstar Quantitative issued a new research note on Wednesday labelling Prospa as “undervalued”, with a fair value of $3.45.

- EDITOR’S NOTE: After closing at $2.10 on Thursday, Prospa shares rose on Friday to finish the week up 3.8% on the day at $2.18.

Trending

Daily startup news and insights, delivered to your inbox.