The Airwallex team.

Investments in Australian startups have nearly doubled in the past 12 months to nearly $7 billion, with Victoria leading the way, according to data analytics firm Techboard.

The Techboard Australian Startup and Young Technology Company Annual Funding Report 2018/19, released at Intersekt on Friday.

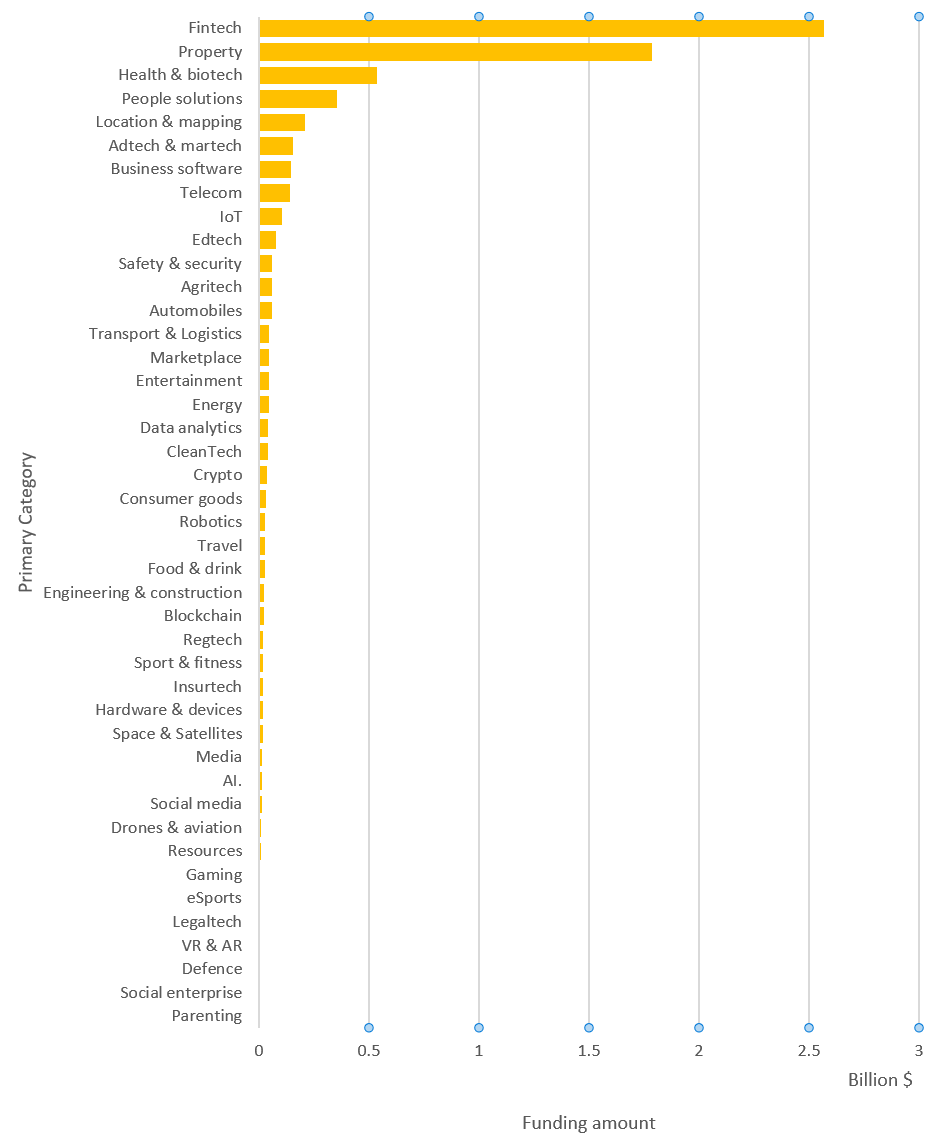

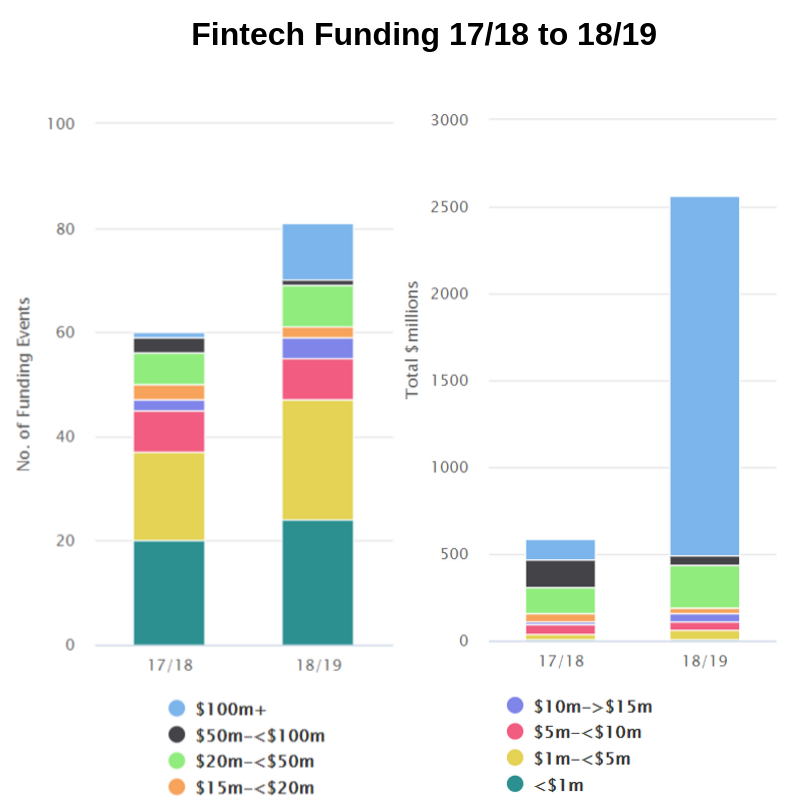

Techboard co-founder and CEO Peter van Bruchem said fintech dominates the FY2019 report, with a five-fold increase in backing on the previous financial year.

Techboard’s analysis of Australia’s angel investment scene captured 836 events for 710 companies, totaling $6.862 billion in FY19. That’s a 96% increase on $3.5b invested the previous year in 633 companies across 728 events.

Techboard operates Australia’s largest directory of startups and young tech companies, with more than 3400 company profiles.

In the two years it’s been running the analysis, Techboard as now seen 1564 funding rounds in 1194 companies, with 148 of those companies holding raises in both years.

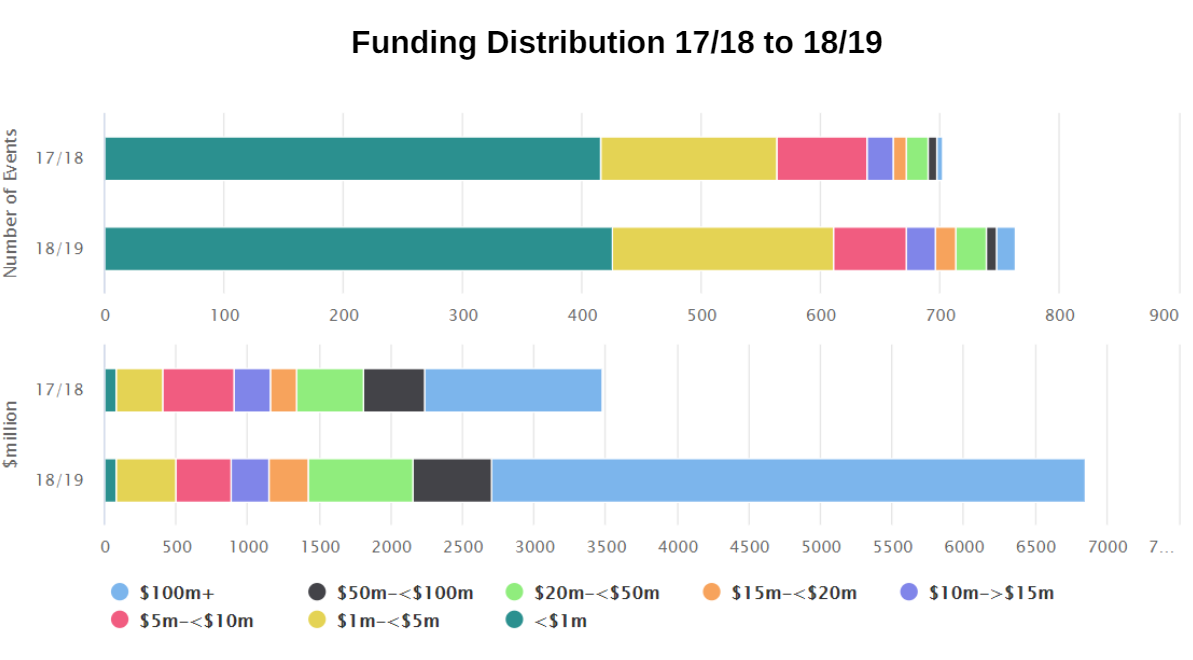

van Bruchem said a maturing of the sector meant funding rounds were generally getting larger as companies also matured. The biggest growth last financial year occurred in the number of funding events above $100 million, with their value up 235% from $1.237bn to $4.147bn in FY19.

Techboard found that investment rounds increased in nearly all the funding bands, the exception being the $5m-$10m range.

The Techboard CEO said the good news is the slowing in funding growth that appeared to emerge at the end of the March quarter did not continue.

June quarter was $1.889bn, up from $635m in the same period for 2018.

van Bruchem said he believes the Australian market reflects the US experience, but on a smaller scale.

“As the VC investors mature, the size of the funds they can raise increases as does the cheque sizes they can and do write. At the same time the companies they are investing in are growing and needing larger investment rounds to stay on their growth trajectory,” he said.

“With Techboard’s consistent and ongoing monitoring we are able to track the growth of the sector – with funding being somewhat of a proxy for growth – and identify if and when gaps may be emerging.”

Australian Investment Council CEO Yasser El-Ansary said the Techboard report shows that growth in both the size and number funding events grew largely in-line with the changes in capital flows into venture funds, with total VC fundraising in 2018 growing to the highest level on record, at $1.3 billion in aggregate.

“The one identified anomaly sits in the $5 million to $10 million funding band, where the data points to a fall in both funding events and overall value in that part of the ecosystem,” he said.

“Given the increase in the size of funds as more institutional-level capital helps to propel the growth of venture in Australia, it perhaps shouldn’t come as a surprise that some gaps in the market might emerge from time to time. How quickly the market responds to such gaps is the important question.”

Key trends

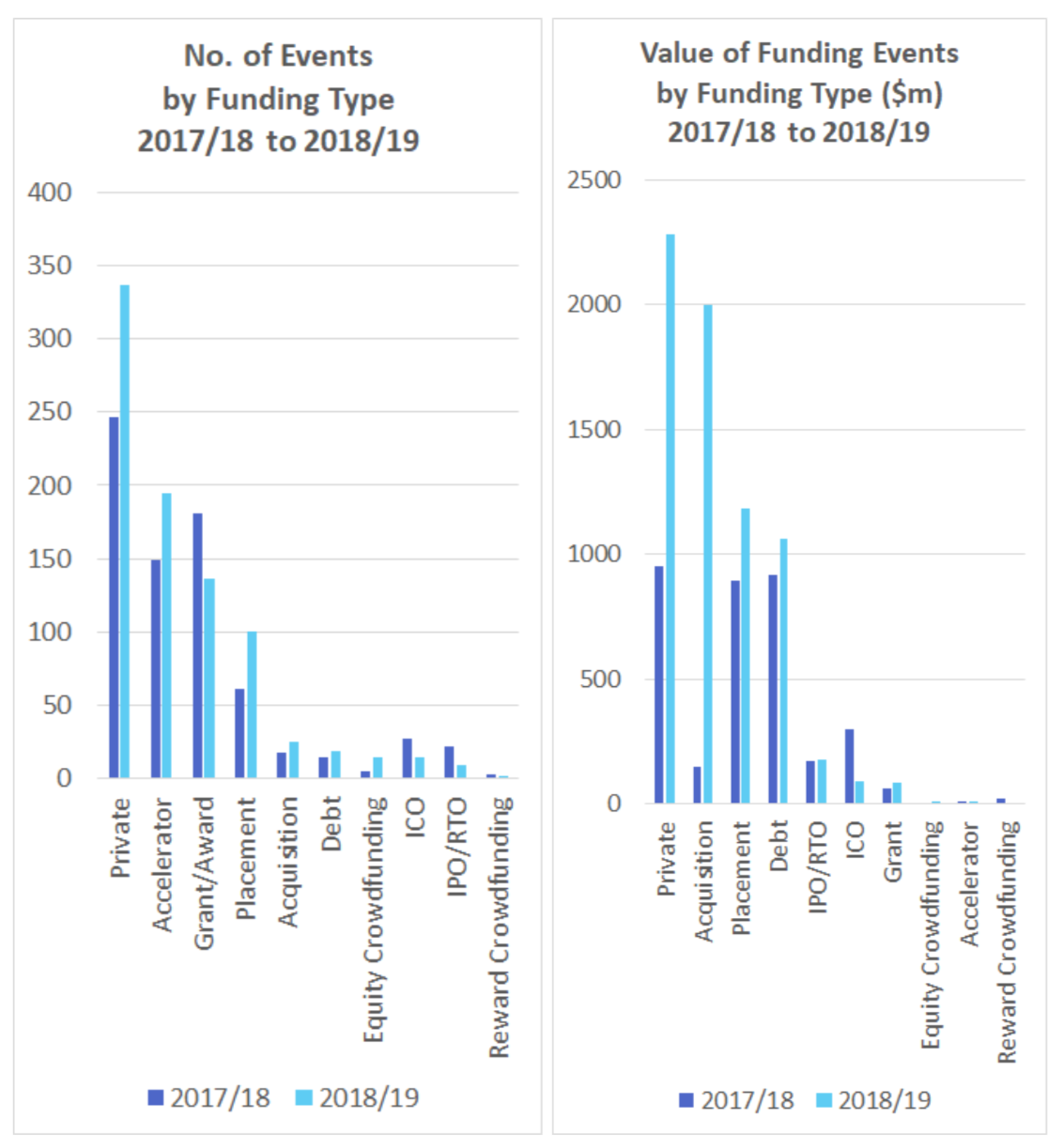

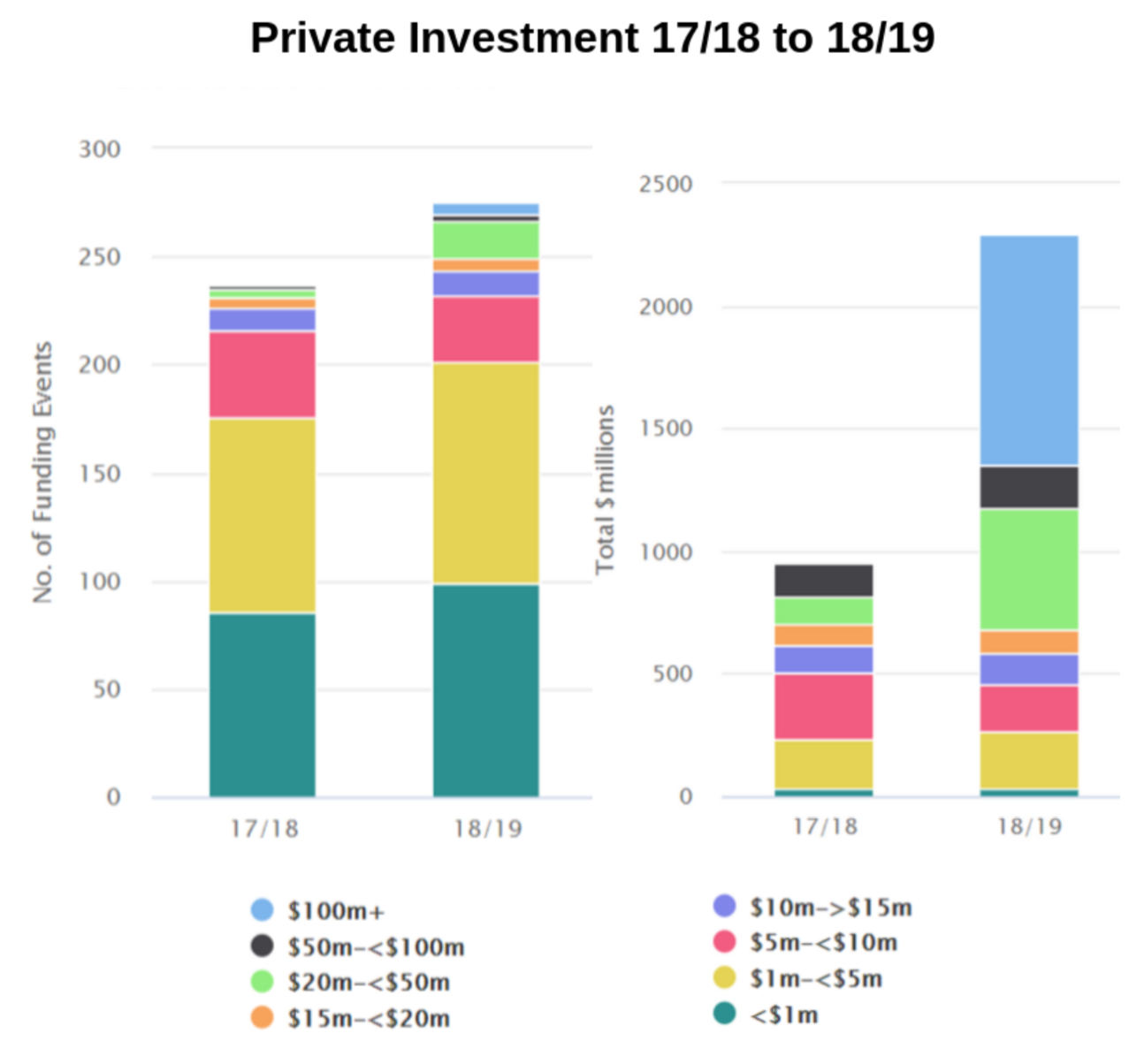

Among the Techboard report’s key highlights was that private investment, including Australian and foreign venture capital, corporate and angel investment, represented a third of total investment, with $2.274 billion – a 139% increase on the previous year.

Judo Bank’s $340 million raise in June (subsequently increased to $400m in FY20) led the pack, followed by Airwallex with US$100m (AU$141m), Deputy’s AU$111m and Canva’s AU$100m.

Judo Bank was the year’s most funded company, securing $930m in two private raisings and two debt rounds.

Acquisitions accounted for $1.996bn (29.2%), with the Property Exchange Australia Ltd (PEXA) sale for $1.604bn topping the list, followed by Spookfish ($136m) and Cresopharma ($122m).

Meanwhile, public investment via the stock-market (IPOs and placements) accounted for $1.288bn (19.7%) of total funding, with debt financing (aka venture debt) at 14.8% ($1.102bn).

The amount raised in new listings via IPO or reverse takeover crept up by 4% to $177m. The listings were bigger but fewer in number, with an average value of just under $20 million, compared to an average of $7.7m the previous. Prospa’s float, raising $109.6m, led the way

All up 100 placements raised $1.176b, led by Afterpay ‘s $317m in the June quarter, following $117m raise earlier in the year. Combined that was 36.6% of all eligible placements for the year.

The largest debt facilities of the year were for Judo Bank ($350m + ) and Moula ($250m).

The largest ICO was for cryptocurrency exchange Nauticus, which raised $26.1m. ICOs dropped to 1% of the overall funding mix bringing in just $92m over the 18/19 year, down from 9% of the funding mix and $297m in 2017/18.

The largest equity crowdfunding campaign was for ridesharing company Shebah, which raised $3m on the Birchal, breaking the new record set by Xinja ($2.569bn) earlier in March.

Grants and awards increased by 34% to $85 million with clean energy company Greensync securing the largest grant for the year at $10 million.

Reward crowdfunding was subdued with no substantial successful campaigns identified for Australian companies over the year and total funding at $299,000 across two campaigns (down from $19.48m in FY18 across three).

Looking at private investment, AIC boss Yasser El-Ansary said there are now around 15 venture funds in market, and many target a $75 million to $150 million capital raise range.

“There are funds at that level would typically be expected to participate in funding new ventures in the $5 million to $10 million range, which may be an early sign that the gap which has emerged in 2018/19 will soon be closed by existing and new funds – good news for entrepreneurs looking to secure equity and debt capital investment at that level,” he said.

The full Techboard 2019 funding report is available for free online here.

Here are six charts that give a snapshot of Australian startup funding in the 2017-18 financial year.

Fintech dominated FY19 events at 37.4% of total funding, worth $2.568bn across 94 funding events. Proptech was 2nd, at $1.735bn (25.4%), although it’s nearly all PEXA’s $1.604bn.

Private investment was a third of total investment, with $2.274 billion across 309 investments; acquisitions accounted for $1.996bn (29.2%), followed by public investment via the stock-market at $1.288bn (19.7%), then debt financing (aka venture debt) at 14.8% ($1.102bn).

More than half the 836 funding events in FY19 were under $1 million. The number of funding events increased in 7 of the 8 size bands, except for the $5-$10m range, which shrunk 18% in deal numbers and 22% in total value.

Deal sizes have shifted since FY18. While private capital investments under $1 million grew by 16.5% to 99 deals, year-on-year, the $20m-$50m band jumped 325% to 17 deals, with the value up 313%.

21 of the 32 fintech raises of $10m or more went to lending startups, representing $2.158bn (84%) of the value of fintech funding at $10m+

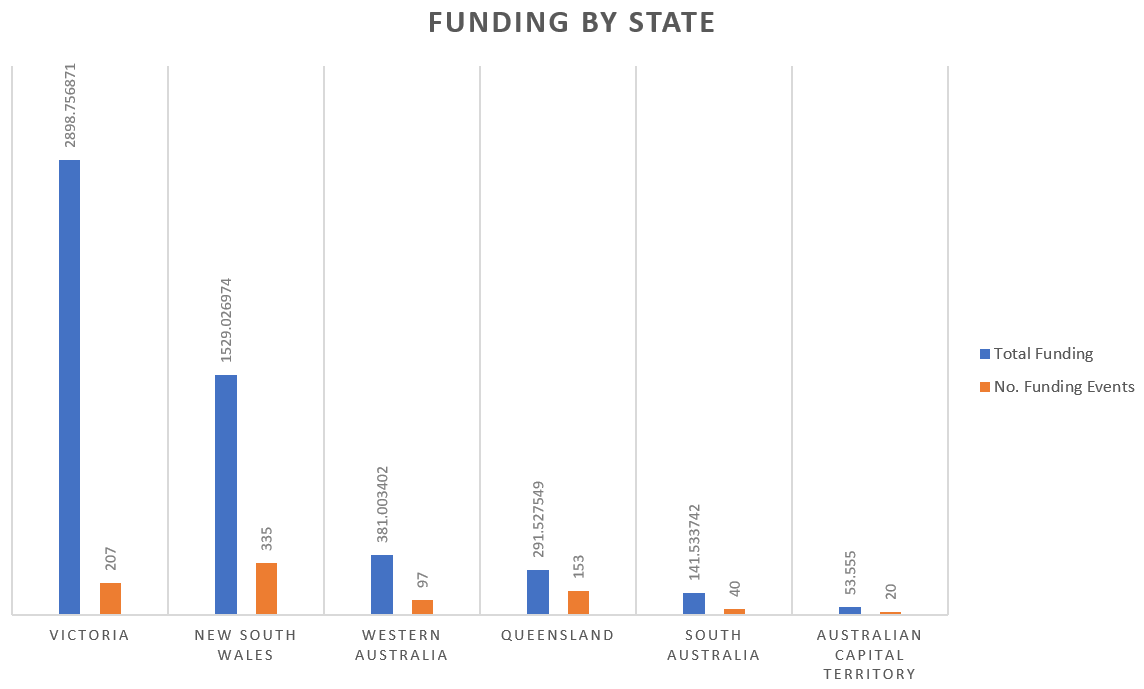

Victoria’s $4.452bn invested in local companies took the lead from NSW at $1.508bn. That’s 65.2% of total funding compared to 22.1%. In FY18 NSW led Victoria 44% to 22.4%.

Trending

Daily startup news and insights, delivered to your inbox.