As WeWork began its ill-fated IPO attempt a few months ago, NYU Stern School of Business Professor Scott Galloway delivered several devastating assessments of the business, which many of his predictions coming to pass.

In the wake of WeWork’s plumment, Prof Galloway has turned his attention to the fintech startup darlings offering buy now pay later (BNPL) services, including Australia’s ASX-listed Afterpay, which as seen its stock double in value over 12 months.

In a five minute YouTube video posted, Galloway turns his attention to Afterpay, Affirm, Klarna – which lands in Australia next year with Commonwealth Bank backing – and acknowledging them as “smart businesses that capitalise on key consumer trends”.

Yes, the BNPL startups have enjoyed “explosive growth”, but returning to a familiar theme for Galloway, they’ve overvalued and the incumbents – credit card companies are coming after them, with Visa planning a similar service in 2020.

Afterpay and its ilk have “one major problem – a lack of moats”.

A moat, he explains, is “a competitive advantage that allows companies to keep their competitors at bay for an extended period of time”.

“These buy now pay later disruptors have puddles rather than moats, which credit card companies can likely breach and step over,” he argues.

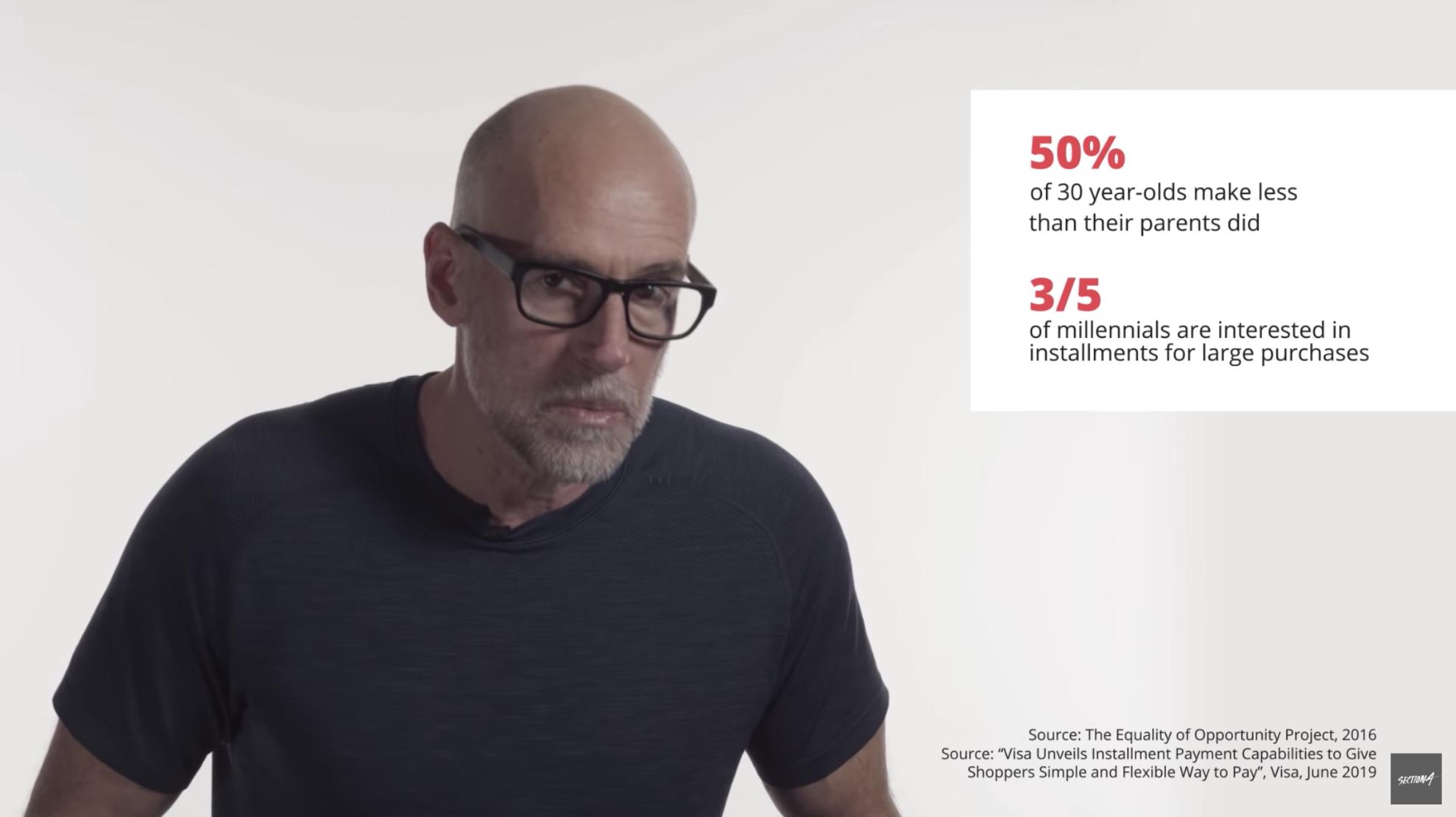

Unlike WeWork, he doesn’t believe the BNPL ventures will fall to zero value because they’ve specifically targeted young professionals without credit cards.

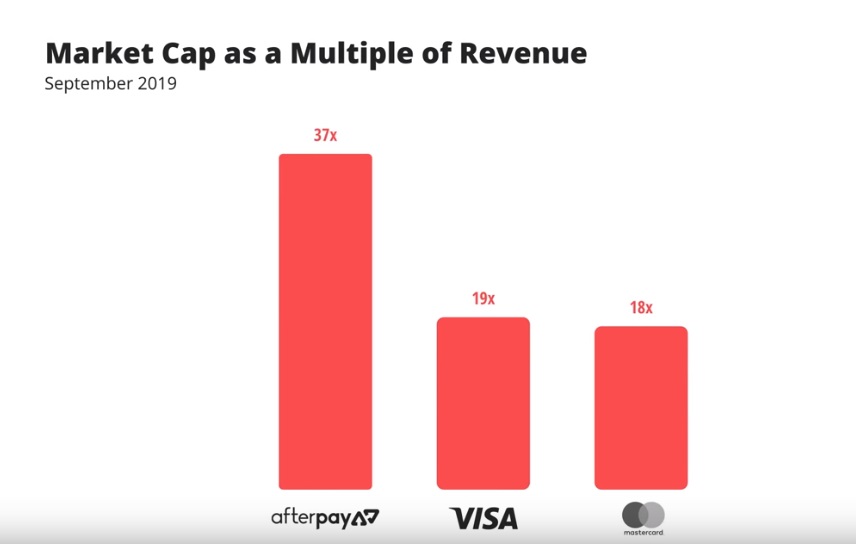

Galloway points to Afterpay’s market cap at 37-times revenue, more than double the credit card giants, with this chart:

Source: Section4/Prof Scott Galloway.

“It’s suspect that Afterpay, whose clientele is really Mastercard and Visa rejects, should trade at twice the multiple of credit cards,” he said.

The Professors thinks the value of the fintech stocks will halve over the next year as the Visa product rolls into town, with Mastercard likely to follow suit.

What should Afterpay and the others do as the cashed up duopoly comes after them?

“Simple, they are trading at exceptional multiples, they should be be making acquisitions and massively reinvesting in the business and the relationship and turning those rivers and those puddles into real moats,” he said.

Afterpay’s share price is down a little over 2% in early trade today to $33.95. It began the year at $12.

Watch Prof. Galloway’s full analysis here:

Trending

Daily startup news and insights, delivered to your inbox.