In the world of SaaS startups there seems to be a belief that investors are only interested in self-service sales models. The theory goes that when customers can sign up online with a credit card, this high-volume, high-velocity sales model allows for quick global scalability. On the other hand, enterprise sales is often frowned upon by Australian VCs as an expensive and slow go to market strategy.

It’s true that for many businesses, investing in digital marketing and a seamless conversion funnel is the best approach to growing revenue. However, at AirTree Ventures we believe there are many ways to build a successful business and my colleague James Cameron has discussed the danger of applying a one size fits all go to market strategy. In AirTree’s portfolio, over 70 percent of our portfolio companies are B2B and very few rely solely on self-service sales to grow their customer base.

Prior to joining the investment team at AirTree, I worked in enterprise sales. My first sales role was at a startup selling a SaaS fundraising platform to charities. More recently I worked at LinkedIn, selling to some of Australia’s largest corporates. I was incentivised to help my clients get the most value of their software solution, which ultimately reduced churn and increased expansion revenue.

So how do you determine the right sales model for your SaaS business? What are the key considerations for investors when evaluating the appropriateness of your go to market strategy?

How much do your customers pay for your product?

At the most basic level, your go to market strategy should be influenced by how much your customers pay for you product. The key SaaS metric to represent the amount of money your customers spend with you each year is Annual Contract Value or ACV. If your customers pay $100 annually for your product, your go to market strategy is going to be very different to that of a business whose customers pay $100k annually.

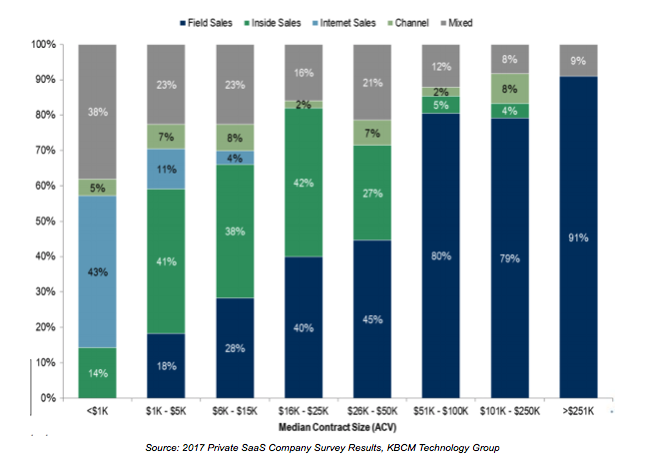

Typically, at ACVs less than $1k self-service sales will the most appropriate sales model to scale your startup. The majority of your customer acquisition cost will be spent on content marketing, adwords and social media advertising.

If your ACV is greater than $1k, you will need to decide whether or not to invest in building an inside sales or enterprise sales team (or both!). A startup can typically support an inside sales team with ACVs over $5k, and sometimes even lower.

At ACVs over $100k, it starts to become necessary to invest in an enterprise sales team. This is the “elephant hunting” referenced by Point Nine Capital’s Christoph Janz in his blog post about the five ways to build a $100m business.

Enterprise sales will often involve an Account Executive as well as a Sales Development Representative to source and qualify leads. This model worked well at LinkedIn. with Account Executives selling to new clients with the support of Sales Development Reps. Once a new client was won, Account Executives passed the account to Relationship Managers to manage the client relationship moving forward with the goal of securing annual renewals, minimising churn. and expanding ACV.

The range between $5k and $100K ACVs is often described as the enterprise sales “valley of death.” If your startup is in this range, you should try to stick to an inside sales model using online demos, phone calls, and remote webinars rather than face to face meetings. Alternatively, the best bet here may be to use a channel strategy.

Below is a chart showing how sales strategies vary by ACV in SaaS businesses. Interestingly, the prevalence of self-service sales (referred to as internet sales) drops drastically once ACV increases over $1k.

How much can you afford to pay to acquire your customers?

The next consideration for the most appropriate go to market strategy for your SaaS business is influenced by how much you can afford to spend on acquiring a customer. This is a question of unit economics. In the long run you need to make significantly more money from your customers (customer lifetime value or LTV) than you spend to acquire them (customer acquisition cost or CAC). The LTV/CAC ratio is a key SaaS metric that investors will analyse.

However, LTV/CAC can also be a trap. Most early stage companies have absolutely no idea what their customer lifetime is so they make arbitrary assumptions based on current churn numbers. If your business has a strong LTV/CAC ratio but it takes many years for your customers to pay back their CAC, you will tie up too much capital in customer acquisition and you will be overly exposed to increasing churn.

AirTree will typically look for CAC to be recovered or paid back in under 18 months at most (6 to 9 months CAC payback would get us very excited!). With that in mind, calculate the contribution margin you will generate from a customer in the first 18 months and aim to spend less than that on customer acquisition, making sure to include all customer onboarding costs in your CAC calculation.

Enterprise sales is typically a much more expensive go to market than self-service sales. If your contribution margin per customer is $10 per month or $120 per year, this cannot support an enterprise sales team as the CAC payback would be many years. In this situation, to achieve a 18 month payback, you should spend no more than $180 on customer acquisition and this is much more likely to be achieved with a self-service sales model. If you can’t acquire customers for this amount, you should be thinking hard about your product, your go-to-market or both.

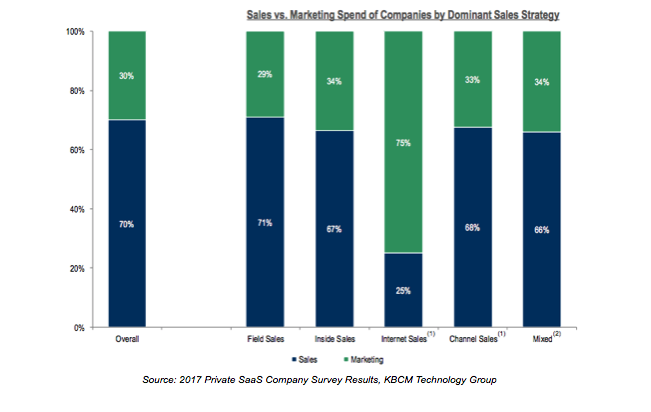

It’s important to point out that even if you choose to focus on self-service sales as your primary sales model, this doesn’t mean you won’t invest in sales resources altogether. The below chart shows that even in self-services sales led SaaS companies, 25% of sales and marketing spend is spent on sales resources. Not surprisingly, 71 percent of spend in enterprise sales led teams is spent on sales costs and only 29 percent of spend is directed to marketing campaign costs.

How complex is your typical sale?

If you have a complex sale that involves multiple stakeholders and significant integrations, a self-service sales model just won’t work. We see so many companies with highly technical products or products that need enterprise wide buy-in who are still trying to overlay an Atlassian-style sales model. It doesn’t work. Even if you are able to acquire customers to sign up for a trial or a subscription, they will churn if they aren’t able to successfully implement and adopt the product to drive a return on investment. In this situation a hands off approach to sales and support won’t work.

Customer success is a key role to drive adoption and engagement with complex products and effective onboarding is key to acquiring new customers, particularly when you are converting trials to paid subscriptions. In this case, a portion of your customer success costs must be accounted for in your CAC. We often see implementation or professional services fees charged in a customer’s first year to cover the costs of successful onboarding. It’s typically for these upfront fees to be 10%-20% of the annual recurring revenue.

Selecting the right SaaS sales model

When selecting the best sales model for your SaaS business, it’s clear the three focus areas in this piece are closely linked. Higher ACVs support a higher CAC and often indicate a more complex sale which naturally lends itself to an enterprise sales model.

If you do decide that building an inside or enterprise sales team is the right approach for your SaaS business, the next step is to determine how to go about executing on it. Two books I often recommend to Founders in this situation are The Sales Acceleration Formula and Predictable Revenue. These books discuss how to build a scalable sales process drawing on the experience of Hubspot and Salesforce respectively and they offer practical advice from sales hiring to sales compensation plans.

Featured Image : | Source :

Elicia McDonald is an Investment Associate at Airtree Ventures, prior to that she held senior business development roles at Linkedin and GoFundraise.

Connect with Elicia on Linkedin or Twitter.

Image: Elicia McDonald. Source: Supplied.

Trending

Daily startup news and insights, delivered to your inbox.