Working in a startup can be a tricky financial risk to take for any party involved. Salary negotiations are more complicated for startups than established companies because they do not have as much cash to offer.

A typical startup compensation package includes some percentage of equity ownership in the company. Offering equity can help motivate employees because they will directly benefit from the company’s growth. Equity packages also ensure the employees who were present at the beginning of the company get rewarded if it becomes successful.

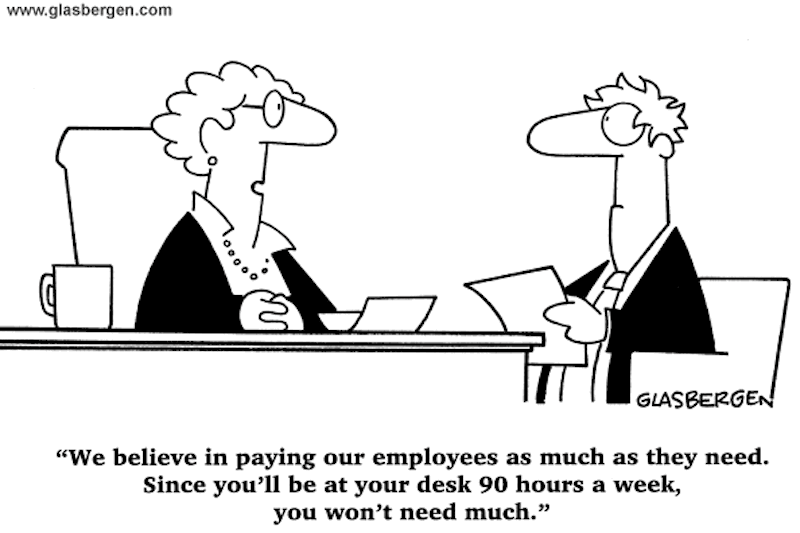

Here are four things to consider, as an employee, when negotiating salary and equity with a startup company. But before all else, the most important thing to do is be courageous enough to negotiate. It’s hard when you’re negotiating with startups that have limited resources, but you can’t undervalue yourself as an employee. A fine balance can be established where both parties benefit.

Assess the company’s finances

Look at the company’s financial situation and business plan to determine the appropriate level of compensation. A lucrative contract will not be worth much if the company cannot actually pay your salary. Pay close attention to the plans for future cash flow and whether sales are expected to increase or the company’s survival is contingent on finding new investors.

The other important reason to assess a startup’s financial circumstances is because there may be debts that will affect your pay. The problem can be circular. They don’t make enough sales or clients are late in their bills – therefore they can’t pay you and you can’t pay your bills. There’s nothing worse than being trapped in this circle.

Consider the people in charge of the company, their prospects for success and the likelihood they will sell out if a venture capital deal is reached. Experienced CEOs and founders may have a better chance to repeat success with their next company, but could also be more likely to exit the company early.

Negotiate a cash salary

Cash salaries for startups may not be comparable to established companies in the same industry. You may be willing to give up some cash in exchange for equity in the company. Be careful if you will not get any salary for more than a few months. This may be a sign that the company will never have enough cash to cover its payroll.

Employment contracts that expect you to also invest capital while receiving no salary should also be approached cautiously. You may never be able to get enough out of the deal to recover your investment plus time worked.

Consult a professional

Enlist the help of a lawyer or accountant, especially if this is your first job with a startup. An accountant can help analyse financial statements and business plan to see if the company’s cash flow projections are reasonable.

Bringing in an outside consultant is especially important if you are not close with the founders or you are coming in at a different stage of the company’s growth. Existing shareholders may have incentive to structure the deal so it is unfavourable to new investors.

An accountant can help analyse financial statements and business plan to see if the company’s cash flow projections are reasonable.

Consider different equity packages

When evaluating the equity portion of your compensation, look at the total number of outstanding shares already issued by the company. Future investments may dilute your equity to an unacceptable level.

Startups generally offer equity in the form of a straight stock grant or option to purchase shares at a specific price in the future. Stock options are riskier because they depend on the company’s share price rising. Your options will be worthless if the company struggles and the share price drops below the option price.

You should also compare the vesting schedule of any grants or options with your long-term plan for employment. You may not be willing to stay with the company long enough to become fully vested.

Ask for fringe benefits

Even if the company cannot afford to offer a higher salary or more equity, it can provide other types of benefits to make the job more attractive. These often include additional voting rights, buyout options, anti-dilution protection or a seat on the board of directors.

Regular fringe benefits such as health insurance or use of a company car also boost the value of the company’s overall compensation package.

For a more personal perspective, have a read of the following article by Michelle Wetzler who gets down to the nitty gritty of negotiating with founders: HOW I NEGOTIATED MY STARTUP COMPENSATION.

Trending

Daily startup news and insights, delivered to your inbox.