Kogan.com has continued its expansion beyond electronics, partnering with Adelaide Bank and Pepper Group to offer home loan products.

Expected to launch this financial year, Kogan Money Home Loans will offer home loan products to homeowners and investors, with Adelaide Bank to provide conforming, or prime, home loans and Pepper to provide specialist and near prime or non-conforming home loans.

A prime or conforming loan is typically provided to borrowers who are considered to be of high quality, while a non-conforming loan sees a lender look beyond the typical lending criteria to lend to borrowers with, for example, a less than perfect credit history, a new job, or work history that suggests instability.

According to an announcement to the ASX, Kogan.com will provide branding, marketing, and customer acquisition, in turn earning a fee on all home loans.

David Shafer, executive director of Kogan.com, said, “With well over a million active customers, Kogan.com is proud to be able to form partnerships like these that form a genuine win-win-win for both Adelaide Bank and Pepper, for Kogan’s shareholders, and most importantly, for Kogan.com customers.”

Damian Percy, head of strategic partnerships at Adelaide Bank, added, “Together, we believe we can make a real difference to the emerging community of Australian online shoppers by delivering simple, great value housing solutions through Kogan Money.”

The launch of Kogan Money follows a strong year for the company, with Kogan.com reporting last month it had grown its active customers by 45.3 percent to 1.388 million in the 2017/18 financial year.

The company also grew revenue by more than 42 percent to reach $412.31 million. Its net profit after tax, meanwhile, grew to $14.11 million, up 277.3 percent.

It came in hand with the company launching a series of new products: Kogan Insurance, Kogan Health, Kogan Internet, Kogan Life, and Kogan Pet all launched last year.

Meanwhile, the partnership with Kogan.com for Adelaide Bank follows its link up with digital home loan startup Tic:Toc.

Founded by former Bendigo and Adelaide Bank executive Anthony Baum with funding from the bank, Tic:Toc promises consumers it can approve a loan in just 22 minutes thanks to a ‘digital decisioning system’ that can approve an online application almost in real time, with no need for input or assessment from a human.

With its loans funded by Bendigo and Adelaide Bank, the startup’s loan portfolio has grown to more than $170 million since launch last year, with Tic:Toc also reporting it has received over $1.2 billion worth of home loan applications.

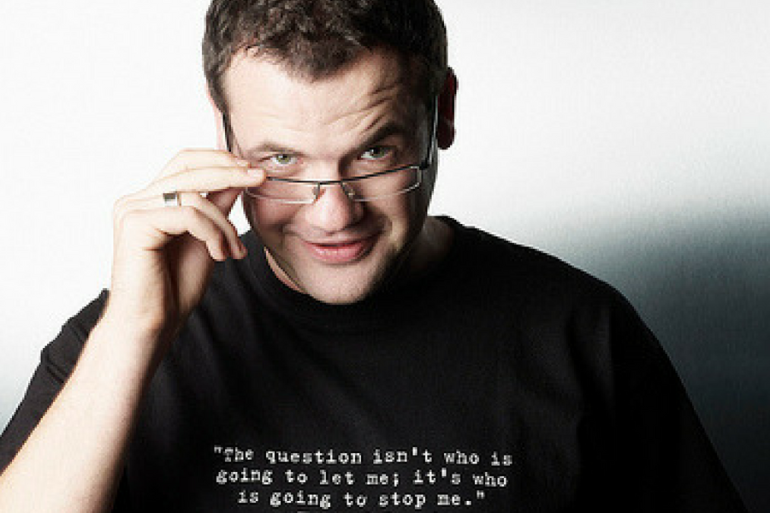

Image: Ruslan Kogan.

Trending

Daily startup news and insights, delivered to your inbox.